Who Is Quartet?

Who is Quartet?

Acting on behalf of both buyers and sellers, The Quartet Family Office works closely with sophisticated and experienced collectors and those who are beginning their investment journey to handle investments and wealth management for ultra-high-net-worth individuals and families.

Located in the UK and Palma de Mallorca, Quartet Family Office was formed after many of our clients were growing frustrated with their sources at the transparency of the process chain and structure of certain transactions.

By combining our knowledge and talents of various markets into a more efficient value proposition, we offer a unique, simplified and, above all, completely honest approach within the Family Office world. We have a deep understanding of our client’s needs, risk tolerance and other investment criteria in addition to always maintaining a high level of confidentiality and privacy of their assets and investments.

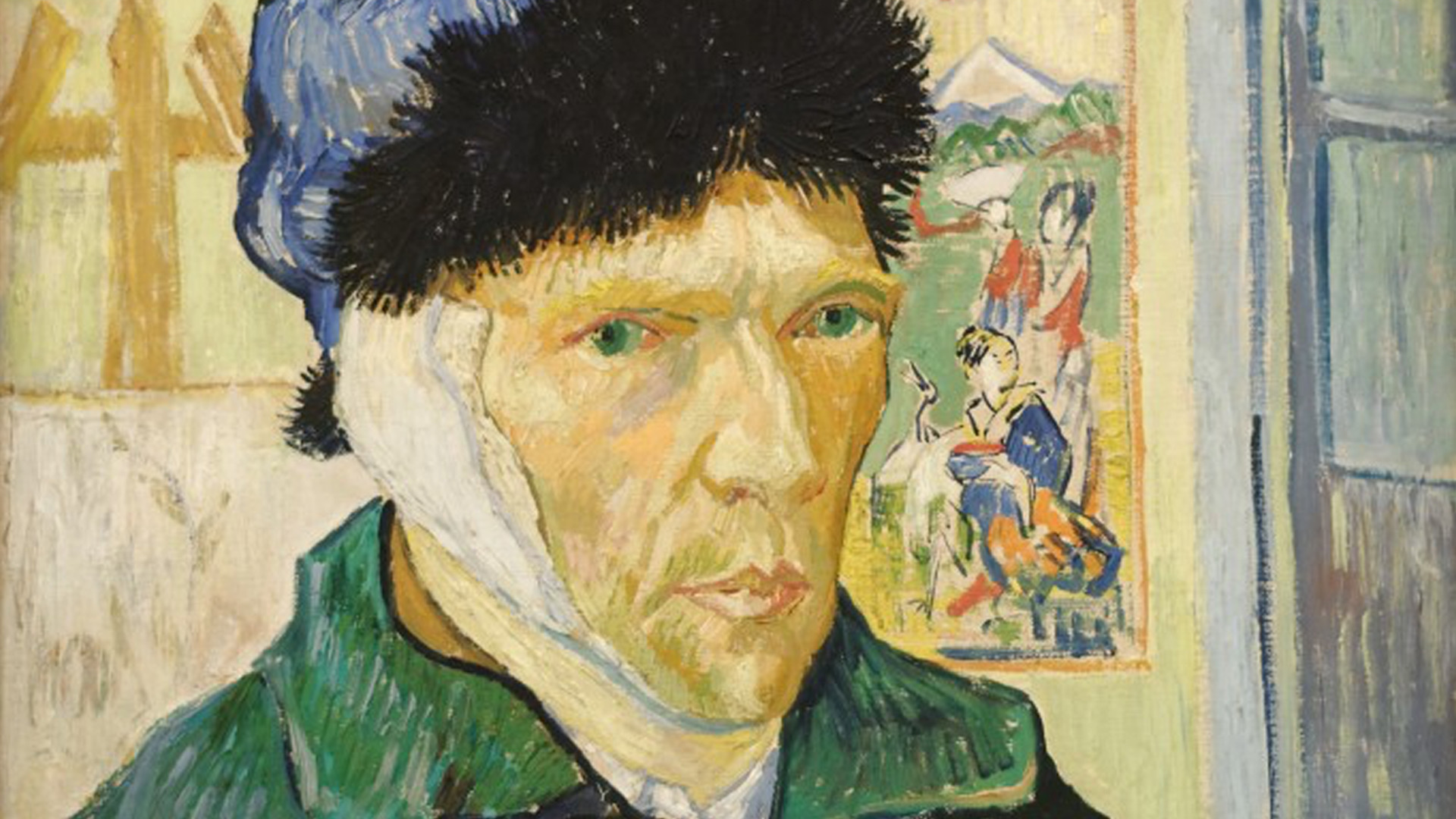

We work closely with our clients as their trusted advisors and consultants in the sourcing and validity of valuable investment assets. Through working with us you are assured of having a reliable business partner who is experienced in the sourcing, transacting and delivery of a wide variety of assets including fine art, blue-chip classic cars and supercars, prestigious property, gems and rare collectables.

We recognise the urgency and confidentiality of buying desirable objects which is why our new clients are often referred to us by our existing client base. They like clarity, crystal clarity.

We are fortunate enough to have seen and worked on many of the world’s most valuable, rare and most private assets on the globe and welcome you to join us in these experiences.

Our Services

Our Services

The Quartet Family Office specialises in creating multi-generational, wealth preservation platforms to accomplish each of our clients’ objectives to ensure the flawless integration and delivery of each acquisition:

- Direct access to genuine artworks, cars, yachts and property in Europe, USA and the Middle East

- Sourcing assets to match the exact requirements of each client

- Legal support | Banking & Escrow Facilities | Financing

- Buyer / Seller identification, KYC

- Full support and management throughout; structuring the deal, managing teams, cross cultural communication, market research

- A network of trusted professional advisers for matters such as tax, logistics and insurance

- 3 rd Party independent valuations and expertise; condition reports; authenticity certificates

- Post sales, independent advice around the on going valuation & care of each asset to increase its investment potential over time

What Makes Us Different?

Quartet Family Office

- Professional, reliable individuals with deep experience in key asset areas: vehicles, art, yachts, aviation, property, rare collectables and finance

- Passionate and motivated to assist clients in obtaining the best possible deal for all parties

- From start to finish, we work with you every step of the way and integrate a singular viewpoint to provide greater transparency, efficiency and control

- Via our professional network we conduct fundamental research and reviews which precede any individual security purchase

- By simplifying the acquisition process and applying knowledge and expertise, we make the process of buying Alternative, Exotic and Valuable Assets more real and less risky

Other Family Offices

- Tend to be experienced in one or two areas only

- Lack of transparency concerning a potential deal, thus delaying the process

- Involvement with many intermediaries and no clear way of delivering which often results in buyers walking away

Who are Quartet?

Who are Quartet?

Edward Hathaway

BA (Hons) Mallorca, SpainEdward is a founding member of the Quartet Family Office and heads up the Palma de Mallorca office. Prior to moving to the sunnier climates of the Balearic Islands, Edward started his journey in the business world in Manchester. He was a key member of the marketing team at EMAP Media (now Bauer Media Group) before being headhunted by Lycos to help set up their northern office as they entered the online frenzy. He was then asked to join Walsh Simmons where he was an integral part of the team behind the famous Laterooms.com website, proving to be the benchmark in the online hotel booking sector.

Edward then went solo and entered the world of hospitality, owning numerous venues in the north west of the UK. He also set up The Buzzing Butler which was maybe 20 years too soon to rival Deliveroo and Just Eat. Not long after the birth of his son, his family decided to move to Palma where Edward put his working ethos into his passion for yachts, art and blue chip vehicles. He established a couple of companies which supply the yachting industry with a variety of services, one of which is possibly the world's largest selection of land and sea toys for sale and rent dedicated to the yachting sector.

Luke P.N. Dugdale

Chartered MCSI CeMAP London, UKLuke is one of the founding partners of Quartet Family Office. Quartet advises FOs, UHNWs and HNWs on all aspects of managing exotic assets including advisory, acquisitions, sales, logistics, lending, collecting and management. Before Quartet, Luke founded Cadell+Co which was the first independent art adviser to be regulated by the FCA and focused on professionals with fiduciary responsibility. It offers independent, professional and transparent advice to trustees, trust directors, multi and single-family offices, lawyers and private banks.

Luke is renowned to be one of the leading bankers globally to specialise in art finance and art logistics. In the “Spears 500” from 2015 to the present day, Luke was deemed “Outstanding in his Field” in the Art Advisory section. He is in the “City Wealth Leaders” list from 2012 through to 2021 and was short-listed for Spears Private Banker of the Year 2012.He has over 35 years of experience in international financial markets as an investment banker, private banker and exotic asset advisor. Before setting up his independent companies he worked at RBC WM as a Director and Head of Art in Wealth Management, Deutsche Bank PWM as a Director and UHNW Desk Head and Head of Art Lending, at UBS Private Bank as an Executive Director and Desk Head. Prior to moving to wealth management in 2003, Luke was an investment banker and was Head of Equity Sales and Trading at Svenska Handelsbanken Investment Banking in London.

Luke has often lectured at the London Business School, The International Bar Association, The Royal Institution of Chartered Surveyors and the Asia Institute of Art and Finance in Shanghai on the subject of art in finance. He is a Chartered Member of The Chartered Institute for securities and investments, certified in mortgage advice and practice, he has a postgraduate diploma in technical analysis from City University.

Joe Tomaszewski

BA (Hons) Manchester, UKJoe is one of the founding partners of Quartet Family Office and focuses primarily on commodity based investments and transactions globally for HNW individuals and private enterprises.

Joe is an entrepreneur and company director who has worked across multiple markets and sectors over the last 25 years. He cut his teeth in the oil and gas industry as a global Head-hunter for O&G specialists within the upstream and downstream verticals for the majors such as BP, Shell and Exon Mobil as well as outsourcing companies such as Accenture, Cap Gemini, Capita, Logica.

Joe has spent the last 10 years working as a commodity trader across the oil and gas markets, agriculture and metals / minerals industries and now works at the highest levels to government across multiple continents working with end sellers and end buyers to enable transactions to complete smoothly. He is the mandate to the Cambodia government and is mandate to several leading oil and gas titleholders, mining companies and end sellers of gold Dore and bullion across the Emirates and Africa.